Last week, we had the pleasure of participating on the “what makes a great PE talent partner?” panel at the PEI Operating Partners Forum in New York. The panel was comprised of human capital leaders – including, Merche del Valle of Grain Management, Alice Mann of Blue Wolf Capital Partners, Ashley Day, a former Chief Talent Officer, and Michelle Nasir of Arsenal Capital Partners.

It was great to be in person with over 200 leading PE ops partners and to have a discussion with those that are talent-focused about what their jobs look like, now that talent operating partners make up 34% of all operating partners, versus the 3% that comprised the PEI ops partner forum 3 years ago.

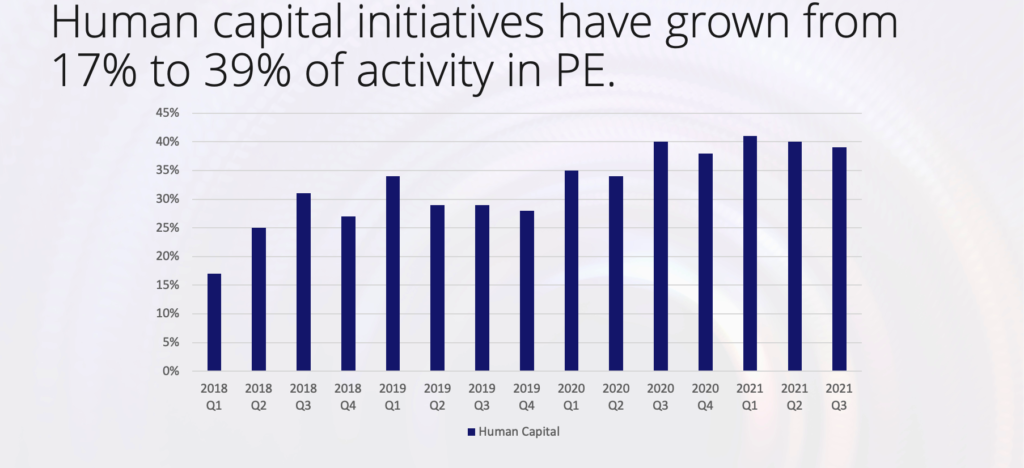

We have seen the increase in human capital importance firsthand, with our proprietary data showing human capital initiatives increasing to 39% of PE activity this quarter compared to 17% in Q1 2018.

In addition to the increase of importance that has been placed on human capital initiatives in PE, data has shown that they have also become wide-ranging, covering everything from interim leadership to exec assessment diligence.

Given this context going into the panel on what makes a great PE talent partner, the below are some of the topline takeaways:

- Talent roles vary widely across funds:

-

- When talking to other panelists, we discovered that some of their talent roles are more internally focused on HR within the PE firm itself, and some are exclusively externally focused on portco executives only. It was also discovered that roles vary additionally by how and when they get involved.

- Working with the deal team:

- The panelists all agreed there have been changes in the amount of time available to fully execute on all of the responsibilities that may have fallen on talent in the past. They said that with this change, funds need to be more regimented and prioritized in terms of how and where they spend their talent team’s time. In terms of executive assessments, interestingly—some assessments have become less comprehensive. BUT, funds have also become more creative with deploying assessments given the tight market. Many are giving offers that are contingent on assessments and background checks going well.

- For work with deal teams—the primary takeaway is that the earlier involvement, the better. Roles amongst our panelists truly varied as to when they got tapped and for how comprehensive a remit, i.e. “do this assessment” vs “ride along on the deal execution to help us spot red flags.”

- Pressurized market:

- Funds have become more regimented due to Covid. They have discovered efficiencies in the process that were developed during the times when everyone was remote and are now helping funds keep up in a highly pressurized market. These playbooks and scorecards have been developed for both internal hiring and monitoring the health of various portcos from a human capital perspective, i.e. turnover, depth of exec bench, etc.

If your firm needs human capital help, we can help make the job easier by connecting you with exact-fit interim executives, HR diligence providers, executive assessment providers, and more. Contact us here if we can be of help and check out our Interim CFO Hub to learn more about how interim executives can benefit you.