Private Equity and the American Economy

The private equity industry has been a vital component of the American economy for years. PE firms invest in companies to improve their businesses and increase their value.

BluWave, the Business Builders’ Network serving the world’s most proactive business builders, analyzed the 2023 Inc. 5000 list of America’s fastest-growing companies to understand the role the private equity industry is playing among those organizations.

BluWave’s analysis revealed that more than 550 private equity-backed companies were recognized in the Inc. 5000, growing exceptionally fast and contributing extraordinarily to job growth.

A Major Representation

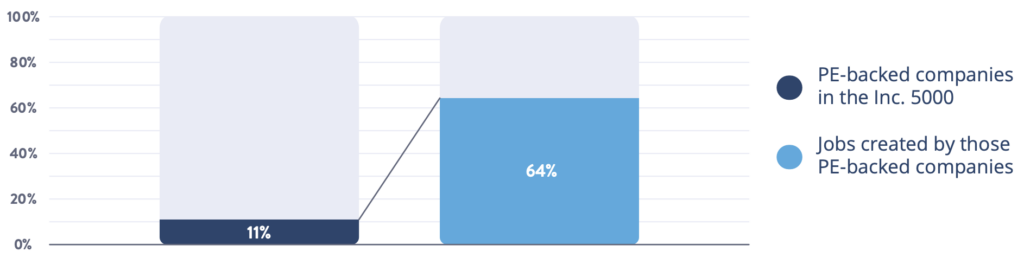

The private equity industry played a meaningful role in the growth and development of Inc. 5000 awardees with approximately 11 percent – or more than 550 of the Inc. 5000 – of the companies on the list being backed by private equity.

The 11 percent of the Inc. 5000 list that is PE-backed accounts for 558 companies.

HCI Equity Partners, a leading lower-middle market private equity firm headquartered in Washington, D.C., serves as an example of one such PE firm. HCI had four of its portfolio companies recognized on the Inc. 5000 list.

These companies provide valued products and services to the food, preventative maintenance, protective gear and hospitality markets. The diversity of industries represented also illustrates the wide range of end markets benefiting from private equity investments.

“We are immensely proud to have four of our portfolio companies recognized in the Inc. 5000,” said Doug McCormick, Managing Partner and Chief Investment Officer at HCI Equity Partners. “It’s a privilege to support the growth and development of such amazing businesses, while providing value to our stakeholders and creating jobs that are built to last.”

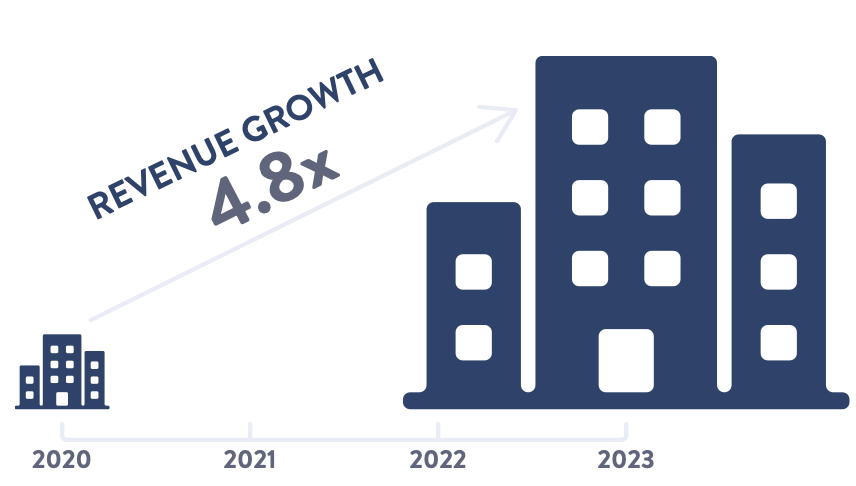

Exceptional Growth

BluWave’s analysis also found that private equity-backed companies grew remarkably fast, with an average growth rate of 480 percent in total revenue over the three-year review period.

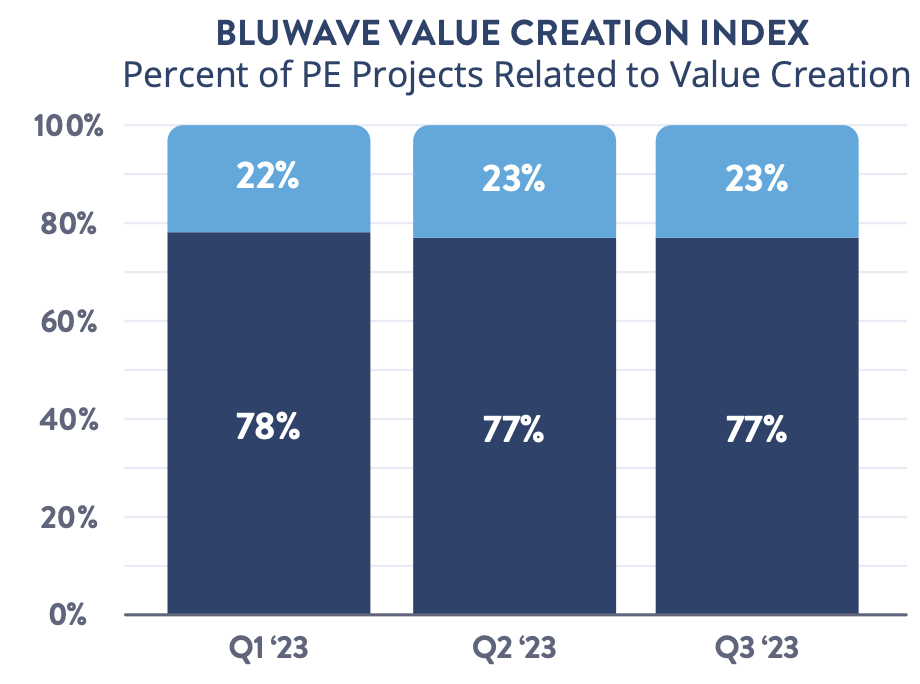

BluWave’s ongoing series of Private Equity Insights Reports have revealed that the PE industry has been able to fuel significant growth in large part due to the industry’s meaningful provisioning of strategic resources. This helps their portfolio companies expand in more accelerated, predictable and confident ways. BluWave’s Q3 2023 Insights report highlighted that more than 75 percent of all projects conducted by the private equity industry in 2023 were related to creating value in their portfolio companies.

“Through thoughtful partnership, HCI has added value across multiple areas of our organization,” said Scott Milberg, CEO of AmerCareRoyal. “In addition to providing access to capital and strategic support, the operational engagement they provide helps us deliver transformational initiatives successfully and accelerate our growth.”

A Major Job-Creation Engine

The influence of PE-backed companies extends beyond revenue growth; they are also significant contributors to job creation.

The BluWave analysis found that private equity-backed Inc. 5000 companies added more than 800,000 jobs over the past three years. While these companies represent approximately 11 percent of the Inc. 5000, they accounted for 64 percent of the 1.2 million jobs added by Inc. 5000 awardees over the past three years.

Furthermore, these companies have been instrumental in bolstering sectors crucial to the U.S. economy, such as software, business products & services, health services, and IT services, adding more than 130,000 jobs in these sectors alone.

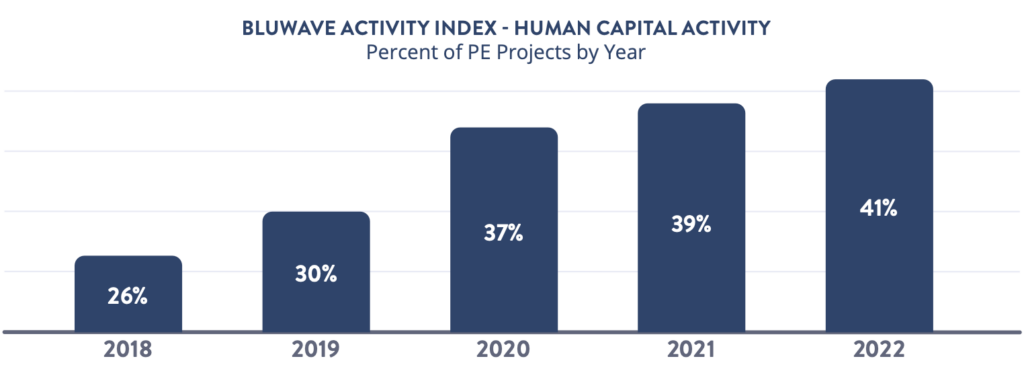

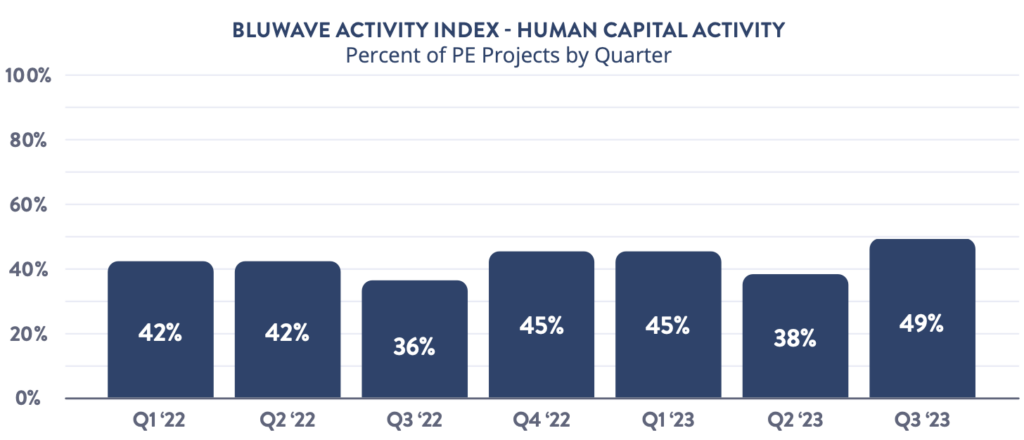

BluWave’s Private Equity Insight reports have revealed that the PE industry has invested heavily in human resources over the past several years. The data shows that human resources has been the number-one focus area in private equity in each of 2019, 2020, 2021, 2022 and YTD 2023. The Q3 2023 Private Equity Insights report showed surging human resources activity, with approximately 50 percent of all projects in Q3 2023 related to human resources. The report also illustrated that four of the top five value creation use cases related to building and improving their portfolio company teams. A copy of the latest report can be requested here.

“We’re not surprised by the job-creation insights highlighted by our analysis. We see every

day how private equity firms focus on building great teams with long-term success in mind,” BluWave founder and CEO Sean Mooney said. “It’s fascinating getting a front-row seat as we help them build and grow.”