Every quarter we gather Operating Executives in PE to discuss current industry topics and to offer peers the chance to gather, share information, and decompress with one another. In our most recent event, we gathered to discuss lessons learned in 2021 that will be reinforced in 2022, creative ways to respond to the Great Resignation outside of paying portco teams significantly more, lessons learned from the seismic shift in traditional economy companies from field sales to inside sales approaches, and more.

These forums are invite-only and follow Chatham House Rules, so listed below are high-level takeaways only. Are you in private equity and interested in joining fellow Operating Executives during our next Operating Partners’ Forum? RSVP for the April 13th virtual forum.

- Innovation from the COVID period and a return to basics: The COVID period has brought a focus on innovation in addition to a doubling down on the basics. Some of the fundamentals in making a company more valuable were sidelined over COVID due to many pressing and urgent pivots forced by the pandemic. Many operating partners are returning to the basics like pricing structure, automation, and expense management, as they can drive change faster and management teams are more open to listening. That said, the remote world continues to challenge relationships with portfolio companies and their management teams, and many ops teams are trying to solve for this by taking the opportunity to visit companies in person whenever they can safely do so.

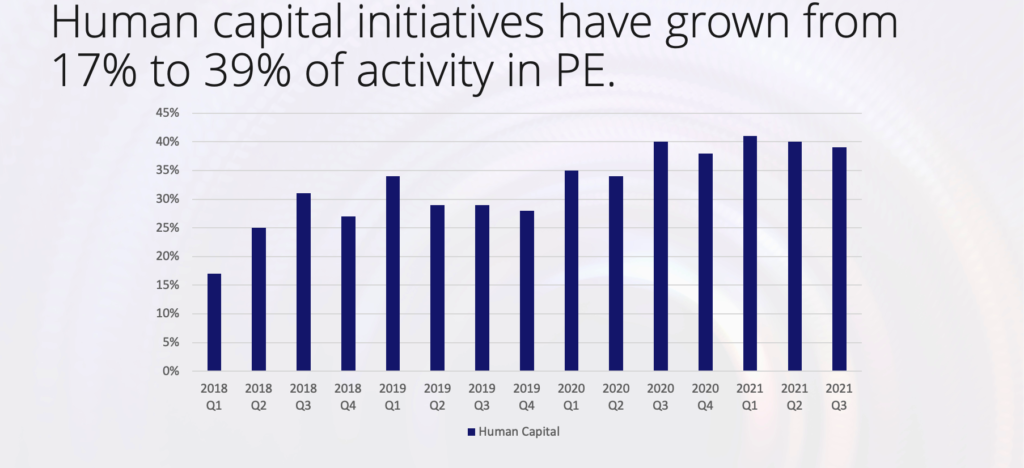

- Pervasive human capital issues due to wage inflation and scarcity: Nearly every participant expressed challenges related to turnover, recruiting, and wage inflation. These issues are complicated by the virtual or hybrid work postures of portfolio companies. PE firms are holding monthly portfolio-wide forums with key portco execs to share best practices. Portcos are doing things like town halls, stay interviews, and regular employee engagement surveys. PE firms are staying closer with portfolio management teams to ensure they have a handle on turnover, wages, and local comps. Culture continues to surpass most other factors in attracting and retaining key talent.

- Moving from field sales to inside sales: Portcos with field sales teams are shifting to inside sales. Operating teams are helping equip these evolutions in a number of ways, including ensuring portcos have the right talent for the roles and bringing in expert advisors to help get the plan right the first time. Shifts to inside sales are being coupled with greater emphasis on account-based marketing, brand, content, and thought leadership via social media.

- Digital transformation has been rapidly accelerated: After never quite gaining traction pre-COVID, digital transformation initiatives have been pulled forward by years. Popular digital transformation use cases included remote work, telemedicine, sales and marketing, and cloud migration. Digital transformation initiatives were previously justified based upon potential cost savings, but are now being made with customers and top-line growth in mind.

- Analytics Taking Hold: COVID caused many to go deep into their data to inform strategies and tactics. PE firms are now building true analytics capabilities (including SQL, Python, and R know-how) internally and externally.

We thoroughly enjoyed getting to gather with PE Operating Executives to discuss these current hot topics and discuss how 2021 learnings will influence 2022 plans. If we can be of help placing interim executives, connecting you to a group that can help facilitate a digital transformation, or be of help with any other need, please contact us.

Interested in learning more about BluWave? Check out our Introduction to BluWave video to learn more about us and how we can help you.