The deeply personal nature of healthcare services, coupled with the growing demand for aesthetic treatments, presents unique challenges that demand a nuanced approach to marketing.

Traditional, one-size-fits-all strategies fall short when it comes to addressing patient concerns and ensuring privacy. Today, successful healthcare marketing strategies must be as personalized and considerate as the services they promote.

This is especially true in a sector where trust and reputation are not just important but are the very foundation upon which patient relationships are built.

Let’s talk about the specific challenges healthcare services businesses tend to face along with the resources available to overcome them.

READ MORE: Healthcare Compliance: Due Diligence Checklist

Healthcare Services Digital Marketing Challenges, Solutions

Challenge: Respecting Patient Privacy

Healthcare services, spanning from aesthetics to dental practices, demand a digital marketing approach that is both sensitive and strategic. The personal nature of these services means that marketing efforts must prioritize patient privacy while still engaging potential new customers and providers.

In an industry as competitive as healthcare, a robust online presence is not just beneficial – it’s essential. This involves a multifaceted strategy that leverages SEO, paid search and social media to not only reach but also resonate with the target audience.

Solution: Industry-Aware Digital Strategies

Addressing the unique challenges of healthcare marketing requires tailored strategies that respect privacy concerns and the regulatory environment. These strategies must focus on patient acquisition and retention, emphasizing trust and expertise.

This is best done with expert help who can craft messages that resonate on a personal level and effectively utilize diverse channels, such as email and social media. A comprehensive approach that integrates various digital marketing tactics is more likely to create a cohesive and impactful online presence that attracts more clients.

Challenge: Attracting New Patients Post-Acquisition

For dental practices, the post-acquisition phase presents unique hurdles, particularly in local markets. An outdated web presence or lingering information from previous ownership can severely impact patient trust and, consequently, acquisition.

In healthcare, where reputation and trust are paramount, the accuracy and freshness of online information are non-negotiable. Ensuring that a practice’s digital identity accurately reflects its current branding and services is crucial for attracting new patients and maintaining the trust of existing ones.

This requires diligent management of online listings, reviews and content to present a cohesive and updated digital presence.

READ MORE: Financial Planning & Analysis Resources for Healthcare Industry

Solution: Localized Marketing, Web Presence Management

For dental practices and localized healthcare services, strategies focused on cleaning up and optimizing web presence are crucial. This involves not just a general SEO approach but a localized one, targeting potential patients in specific geographic areas.

Emphasizing local SEO and targeted social media advertising can significantly enhance visibility and patient acquisition, especially on platforms like Google and Bing. The better your strategy takes into account the nuances of online listings, reviews and content, the more likely you’ll create a positive impression for your local practice.

Challenge: Lack of In-House SEO/SEM Expertise

Healthcare providers excel in patient care but often find themselves at a disadvantage when it comes to managing the intricacies of SEO (organic search) and SEM (paid search). Staying visible in either case requires specific expertise that many healthcare providers lack.

This gap in skills can leave providers invisible in a saturated market, where showing up in search results could mean the difference between thriving and merely surviving. The right in-house talent – or an expert third party – can help with this crucial exercise.

READ MORE: SEO Recruitment: Hiring Organic Search Experts

Solution: Hire Expert Search Consultancies

Consultants specializing in SEO and SEM provide invaluable guidance, helping healthcare teams develop and implement effective strategies so they rank higher on search engine results pages (SERPs).

The right third-party partner will not only implement a strategy, but also train in-house teams, empowering them to manage these strategies effectively. This dual approach ensures both immediate improvements and sustainable management of SEO/SEM efforts.

Challenge: Dissatisfaction with Previous Vendors

Dissatisfaction among healthcare entities with previous vendors is another common challenge businesses face.

Partners must understand service-specific complexities while delivering effective digital marketing solutions within these constraints. The quest for such partners is often fraught with the risk of mismatches, leading to wasted time and resources.

Solution: Web Development and Online Marketing

Developing user-friendly websites with easy content management systems is essential for healthcare providers. These websites must not only be easy to navigate but also reflect the personal nature of healthcare decisions and communications.

A careful balance of technical functionality and empathetic content strategy is key, ensuring that the website serves as a helpful resource for patients. Online marketing strategies must then extend this approach, using digital channels to communicate the value and expertise of healthcare providers effectively.

Challenge: User-Friendly CMS, Efficient Integration for Multi-Site Brands

Healthcare networks face the unique challenge of maintaining a cohesive brand and patient experience across multiple locations. This necessitates a scalable web solution that facilitates easy content management and ensures a consistent patient experience.

Systems must be user-friendly while also capable of integrating various sites under a unified brand umbrella. This system must cater to the specific needs of healthcare services, allowing for easy updates and management without sacrificing functionality or patient engagement.

Solution: Branding, Marketing Strategy Overhaul

Services that specialize in healthcare branding can navigate these challenges, developing clear, compassionate messaging that resonates with patients who may be facing a difficult diagnosis.

Expert service providers can help implement a strategic overhaul that aligns branding and marketing efforts with the core values and expertise of healthcare providers. By communicating these elements effectively, healthcare services can build trust and establish themselves as preferred providers in their respective fields.

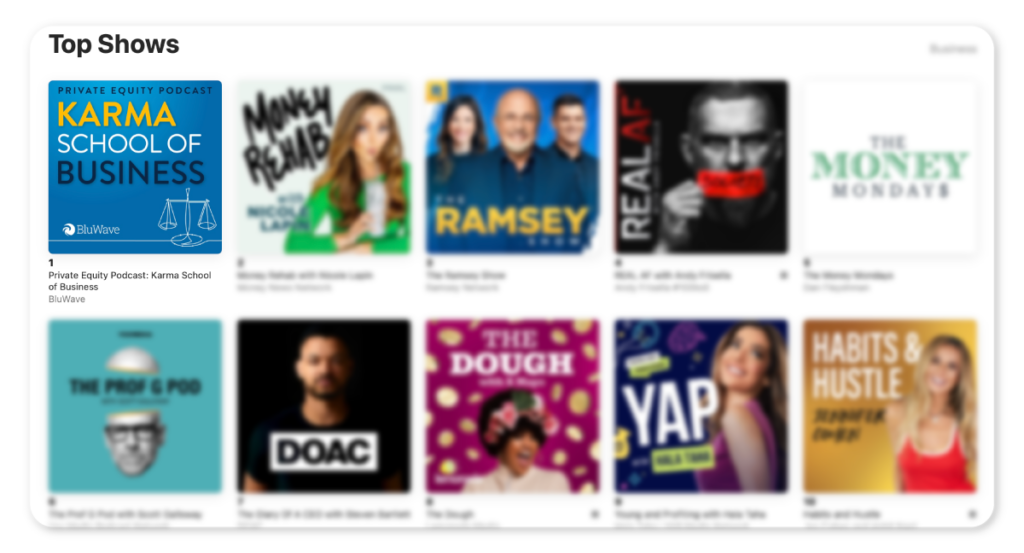

The Business Builders’ Network is full of exact-fit expertise necessary for businesses in the healthcare services industry to achieve their digital marketing demand generation goals.

Our research and operations team specializes in connecting you with the ideal service provider, who understands the sensitivities of your business.

Partnering with BluWave not only simplifies the process of connecting with the right digital marketing solution but also gives you a competitive edge. Set up your scoping call today, and we’ll provide a short list of situation-specific resources within a single business day.