Private equity has a reputation for being an opaque industry to outsiders, with accessible expert insights difficult to find.

Some of PE’s most experienced professionals, however, are out to change that. These in-depth podcasts pull the curtain back on due diligence, value creation, prep for sale and everything in between.

While there are plenty of great options available for download, these are the five best podcasts about private equity to which you should be listening – in no particular order – to max out your knowledge.

Best But Never Final

- Hosts: Doug McCormick, Lloyd Metz, Sean Mooney

- Recording Since: Feb. 6, 2024

- Publishing Frequency: 2–3 per month

For too long, the first word in private equity has been “private.” On this “insider” podcast, McCormick, Metz and Mooney pull back the curtain and get real about private equity.

Listeners will gain a deep understanding of how private equity professionals think and operate. With three distinct backgrounds and decades’ worth of combined industry experience, everyone from CEOs to aspiring PE partners can learn from this dynamic trio.

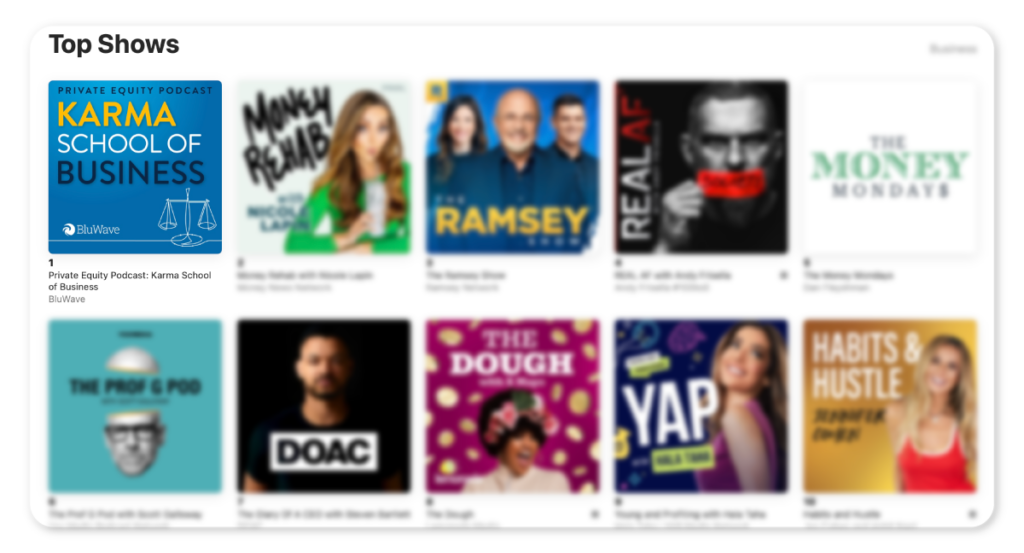

Karma School of Business

- Host: Sean Mooney

- Recording Since: Aug. 2, 2022

- Publishing Frequency: 4 per month

You caught us! Our very own CEO and founder, Sean Mooney, hosts this podcast, too. But we wouldn’t share if we didn’t believe it was full of great content.

Launched in 2022, we cover a wide range of topics with frequent guests, from the role of private equity in the economy to the latest trends and challenges.

“You’ll learn insights and best practices from leading and influential private equity professionals, visionary business executives, and one-of-a-kind industry thought leaders who will help you take meaningful action, improve your business, and enhance your life.”

Dry Powder: The Private Equity Podcast

- Host: Hugh MacArthur

- Recording Since: Sept. 16, 2019

- Publishing Frequency: 2–3 per month

This podcast features interviews with industry leaders and experts, providing listeners with an in-depth understanding of the private equity landscape.

Each episode focuses on a specific topic, such as fundraising or portfolio management, and provides valuable insights and success strategies “that will redefine the private equity industry.”

Private Equity FunCast

- Hosts: Devin Mathews and Jim Milbery

- Recording Since: Sept. 10, 2013

- Publishing Frequency: 1–3 per month

Hosted by ParkerGale Capital, this podcast covers a wide range of hot topics in private equity, from deal sourcing to exits. The hosts bring a unique perspective and a healthy dose of humor to your headphones, making it a great listen for both industry veterans and newcomers.

It describes itself as “a lively discussion of the uses of technology to improve business operations for companies with less than $100 million in revenue.”

And if that’s not enough, they open each episode with a fun, original jingle.

Middle Market Musings

- Hosts: Andy Greenberg and Charlie Gifford

- Recording Since: April 2, 2021

- Publishing Frequency: 1–2 per month

Most private equity deals take place in the middle market, and that’s what this one focuses on.

Industry leaders and experts discuss the latest middle-market trends and strategies.

With a different guest for each episode, you won’t be short on diverse perspectives.

These podcasts are available to download for free on iTunes, Spotify and other popular platforms.