How are private equity firms confronting slower deal flow in 2023? And why is portfolio value creation activity so high?

These were among the hot topics in the latest BluWave-hosted VP forum March 7.

Patrick Murray of Compass Group Equity Partners, Sam Yang of Gauge Capital and Larry Flanagan of Great Range Capital teamed up for the virtual event.

Interested in attending a future forum event? Email events@bluwave.com

Here are some highlights of what was discussed.

Add-On Acquisitions

We’re seeing nearly all-time-high interest in add-on acquisitions due to slower deal flow and platform acquisitions demanding higher multiples.

Add-ons present an opportunity to consolidate market position and average down all-in platform multiples. To ensure successful add-on integration processes, PE firms are:

- Focusing on the people side to ensure cultural alignment pre-close and drive buy-in and excitement post-close.

- Helping management stand up internal teams and building out playbooks so that company leadership can natively run integration processes. The firm will stay involved at a strategic level and drop in to provide tactical support when needed.

Portfolio Value Creation

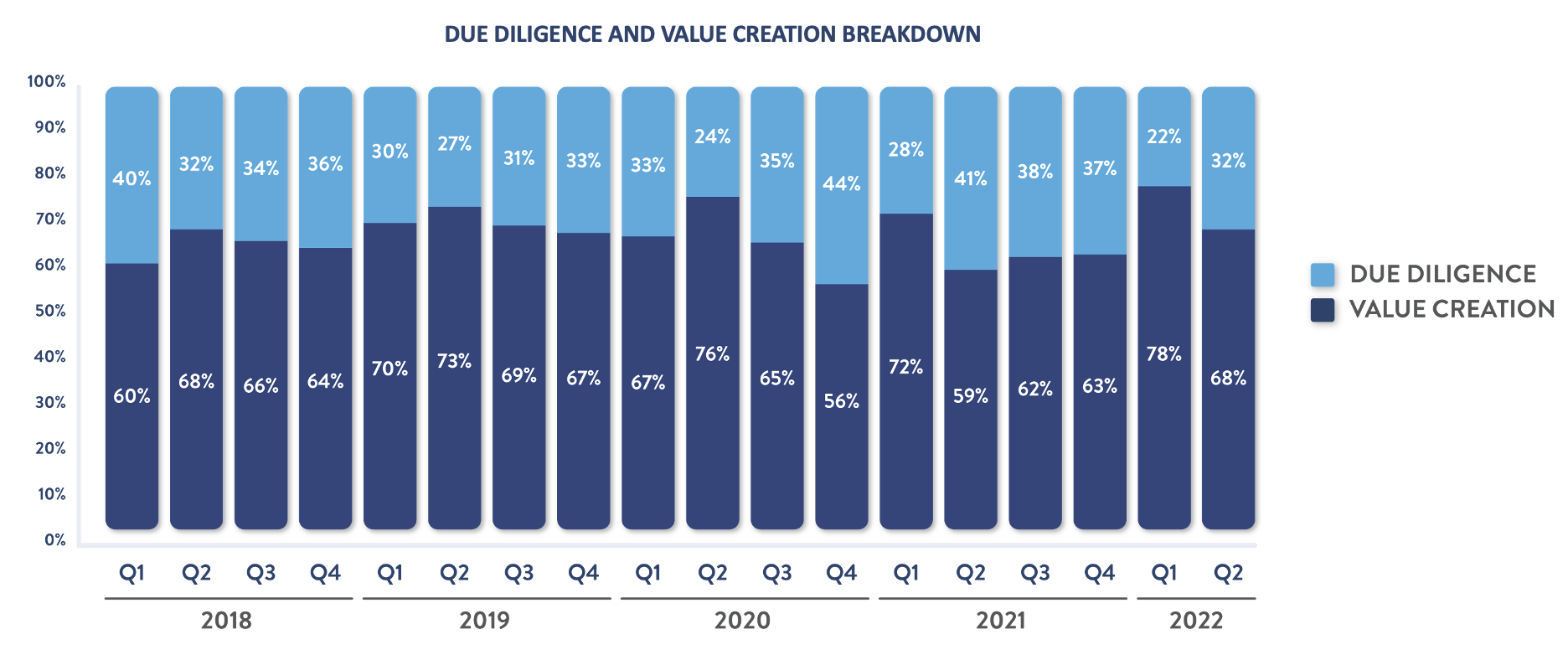

More than 80 percent of projects flowing through the BluWave ecosystem are related to portfolio value creation initiatives, an all-time high.

This reflects lighter deal flow as well as how the industry is “running toward the storm” and turning challenges into opportunities. PE firms are effectively driving portfolio value creation by:

- Working with management, especially founder owners, to educate them on the PE process during the diligence phase. This helps build buy-in so that management feels it has ownership in the value creation plan post-acquisition.

- Standing up a robust go-to-market strategy. Many founder-owned companies are product-focused but do not have the resources or expertise to build a true sales and marketing function. Firms are bringing in CROs or CSOs to develop strategies, set pricing and jumpstart marketing efforts.

- Institutionalizing knowledge within the firm so that it doesn’t sit at one deal or portco. Firms are building playbooks across the areas of people, communication, strategy and operations so that they can take a systematized approach to value creation at each company.

This event was conducted with the Chatham House Rule in place.