Joe DeLuca recently joined the Karma School of Business podcast to talk private equity. The operating partner with NewSpring Capital spoke with host Sean Mooney about the significance of building genuine relationships during crises, the evolution and adaptability of NewSpring’s value creation model and the unparalleled power of collaboration, drawing parallels from the Manhattan Project.

Their insightful conversation sheds light on the human-centric approach to business and the pivotal role of adaptability in the private equity landscape.

Here are some of the top takeaways from their conversation.

3 Takeaways from Joe

1. Building Relationships in Crisis

In the face of unprecedented challenges, such as the onset of the COVID-19 pandemic, DeLuca underscored the importance of human connection and understanding.

“I tried to understand what the people that were working at our business, just what was going on so that we could relate to each other,” he said. “Then I could ask of them, ‘Hey, OK, we really need to do X.’ And then there was some empathy and some relationship building in the first week that I just felt was really critical because it was all happening real-time.”

This sentiment is not just about business strategy but about genuine human empathy. By taking the time to understand the personal challenges faced by employees, leaders can foster a sense of unity and shared purpose.

“People are really what drive these companies,” Mooney added.

In an era where technology and automation are at the forefront, it’s a poignant reminder that at the core of every successful venture are the people who make it run.

2. Evolving Value Creation Model

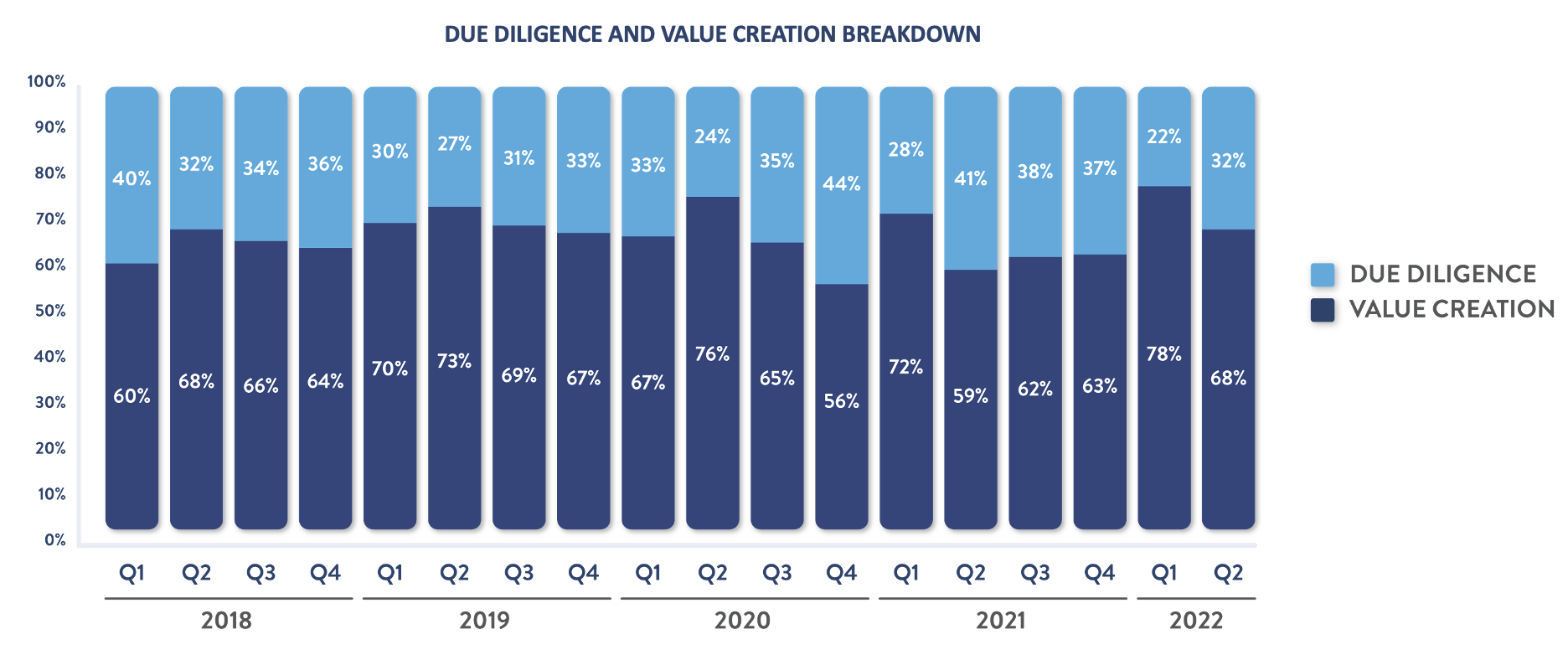

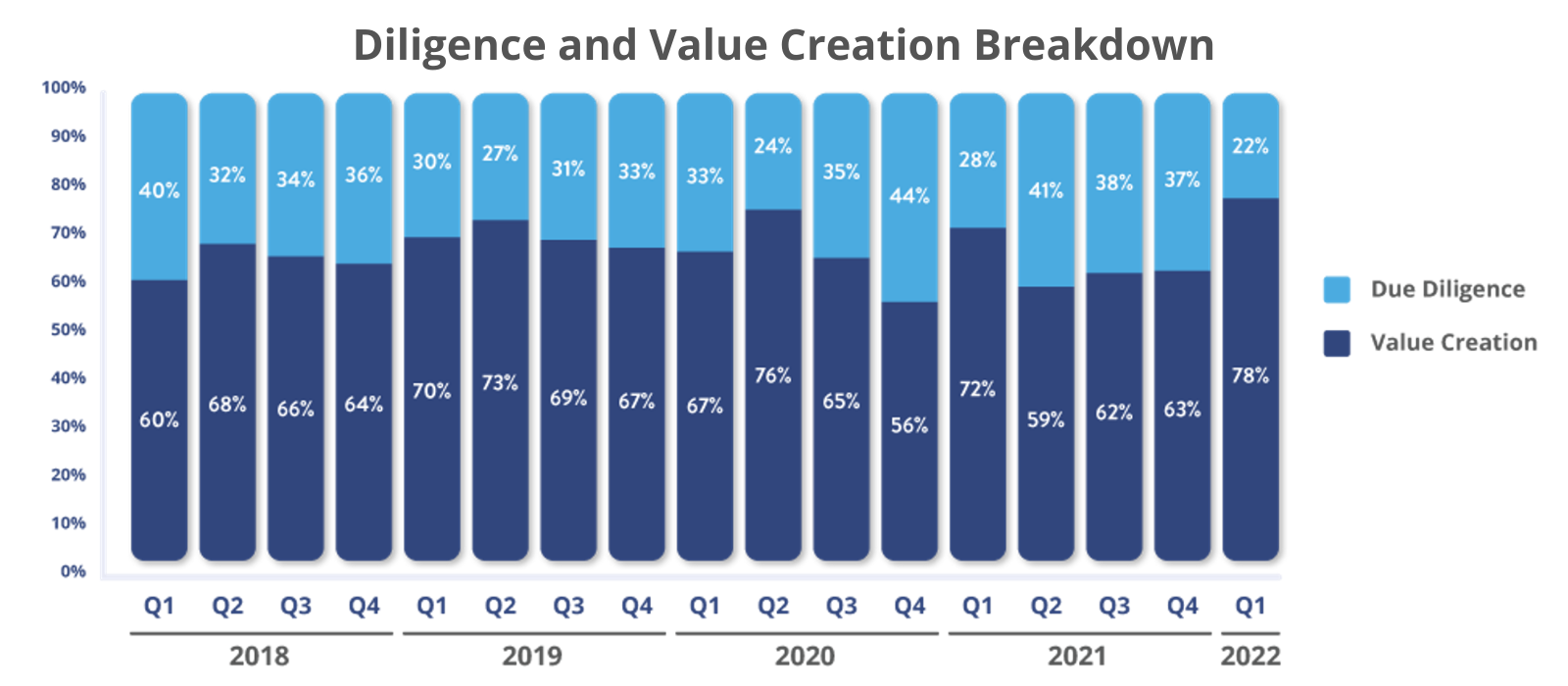

Adaptability is a hallmark of successful businesses, and NewSpring’s evolving value creation model is a testament to this.

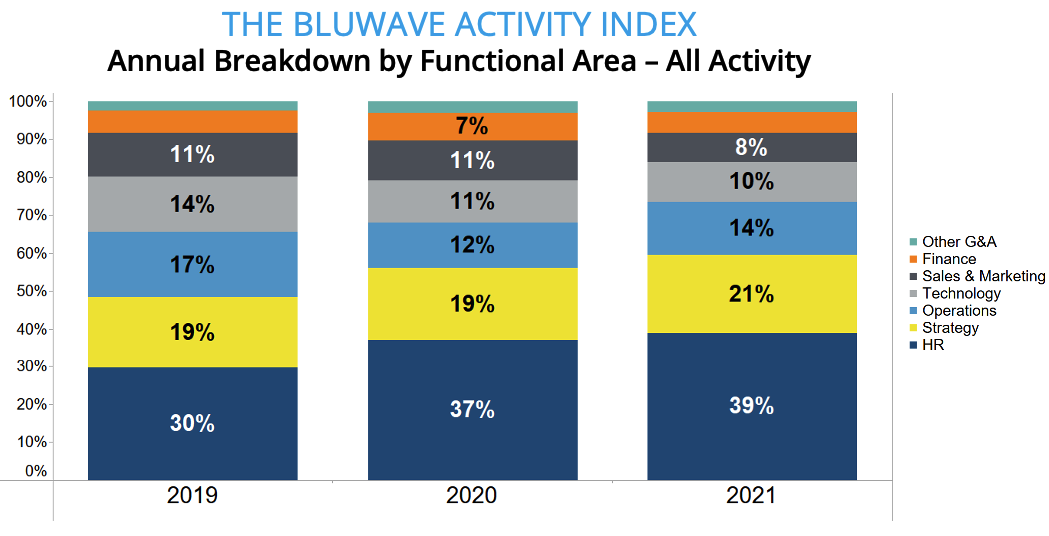

“We started several years ago with what we call the value creation team,” DeLuca said. “The concept was, ‘w’Well, let’s get somebody from each of the disciplines. Let’s have a finance person, a marketing person, an HR person, an IT person.’ You sort of get the idea. ‘And let’s have them on tap to call on them and add value where and when needed.'”

This shift from a broad, external expert-based approach to a more focused, strategy-specific model highlights the importance of being nimble and responsive to the unique needs of each investment.

“The biggest single use case we see in private equity is people,” Mooney said. “It’s every quarter, and it gets bigger and bigger and bigger.”

The emphasis here is clear: while strategies and models are vital, it’s the people who execute them that truly drive value and success.

3. The Power of Collaboration

The story of the Manhattan Project, as recounted in “The Making of the Atomic Bomb,” serves as a powerful metaphor for the importance of collaboration in achieving seemingly insurmountable goals.

DeLuca drew attention to the unlikely partnership between General Leslie Groves and Robert Oppenheimer.

“These guys pulled it off, and they were completely opposites,” he said. “They were like the stereotypes.”

This collaboration between two starkly different individuals underscores the idea that diverse perspectives can come together to achieve greatness.

“If you work with great people, you kind of understand the situation, come up with a plan,” Mooney said. “If you’re tenacious and you’re going to find a way, and I think that so much just reflects the whole conversation that we’ve had here today.”

The underlying message is clear: with the right team and a shared vision, any challenge can be overcome.

DeLuca’s insights on the importance of understanding and connecting with employees during challenging times, the adaptability required in the ever-evolving world of private equity, and the lessons drawn from historical collaborations, make his episode well worth a listen.

When you’re done listening, head to the main BluWave podcast page for more conversations with business leaders.