One of the advantages of providing specialized solutions for more than 500 PE funds and business leaders is that we gain a 360-degree view about what is impacting portfolio companies and the private equity industry as a whole. From our hundreds of interactions with fund managers, interim executives, business leaders, and experts from across industries we learn about trends, themes, and opportunities that affect all aspects of PE. As we look ahead to 2022, we reflect on some interesting insights that we gained from our network, as well as our founder and CEO, in 2021 that point to themes to watch for in the year ahead.

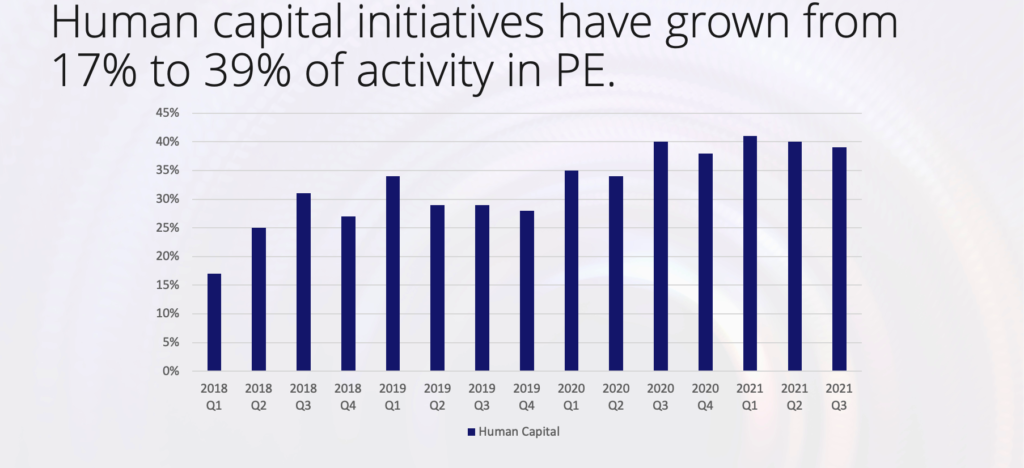

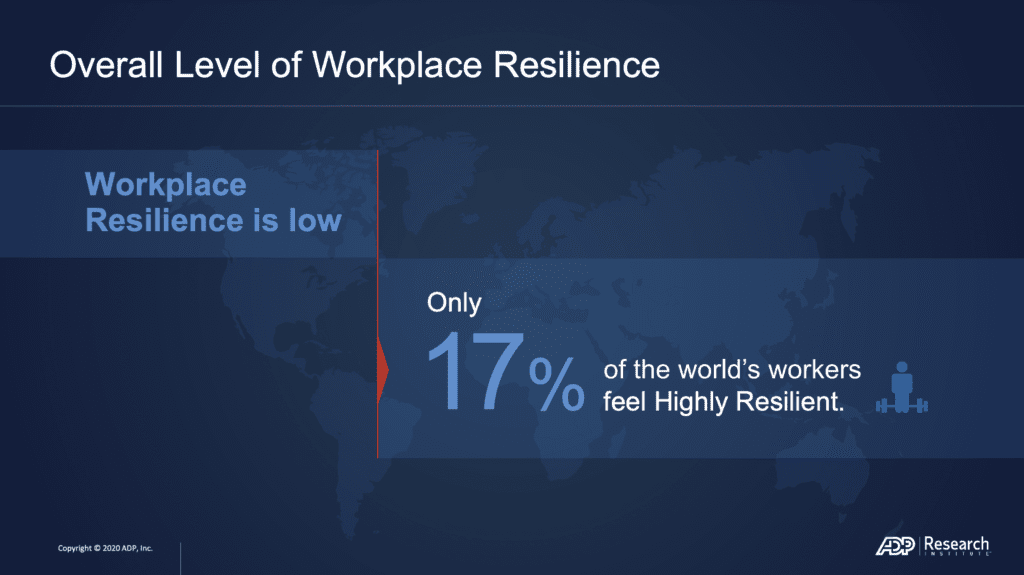

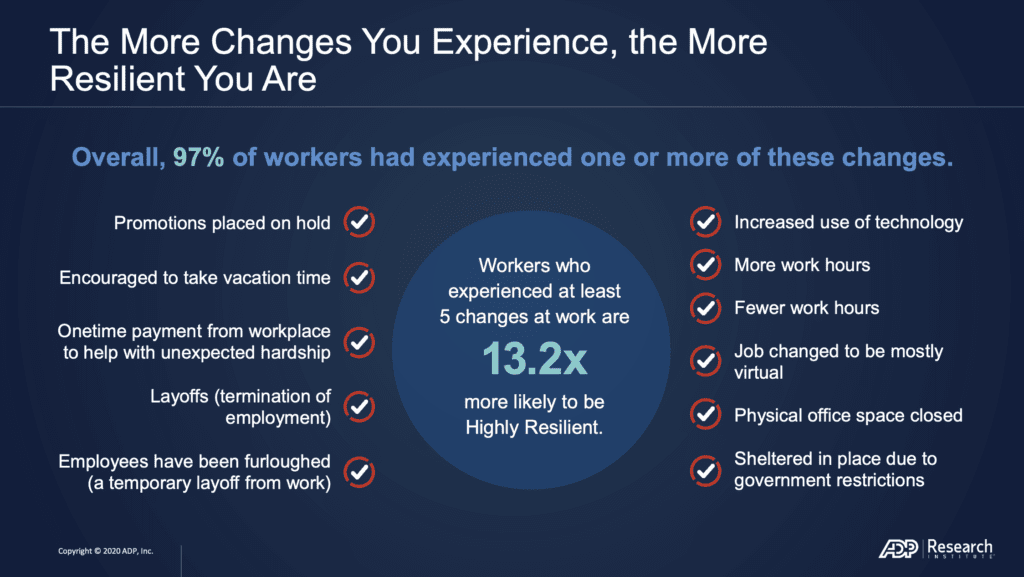

Theme 1: Focus on people as core strategy

While it may seem counterintuitive in such a technology- and-data-obsessed culture, what we’ve seen the past year (with no sign of slowing down) is a commitment to focusing on talent and culture as a core part of business strategy. With an anemic and highly “flexible” job market, companies are thinking of innovative ways to attract and retain top talent in order to compete, including giving the CHRO a seat at the table.

The expert’s take: “I believe human capital is one of the most valuable assets of any successful company. End of story. We have put in place a strategy to have our portfolio companies hire a Chief HR Officer—a role that drives strategic thinking, fundamental change through processes, and design efficiencies. This person’s role is to think strategically about the business, then marry that strategic thinking with decision-making around human capital. He or she understands long-term objectives and implements a hiring strategy to meet these objectives. It was a game-changer for our companies and enabled us to swiftly drive change and make money for the shareholders.” — Matthew Garff, Managing Director at Sun Capital

Theme 2: Public policy and its key role for PE

Recently, Congress and the current Administration have put forth measures that could affect the private equity industry and have a negative impact, particularly on women investors. The industry employs over 11 million Americans and supports thousands of small businesses; a fact that sometimes gets lost when legislators are just focused on the balance sheets of the funds.

The expert’s take: “Washington is trying to move very quickly: it’s like being in a baseball game but not knowing what inning you’re in. Oftentimes the intention of these proposals isn’t nefarious or ill-intended; rather, haste makes waste and politicians are drinking massive amounts of information from a firehose. One minute they are talking to someone like me, with a private equity agenda. The next minute, it’s someone from higher education, renewable energy, or critical infrastructure. Our job [as industry insiders and lobbyists] is to inform them about the realities and potential negative consequences in a non-incendiary way so they will actually listen; subsequently, we hope they make decisions based on the data-rich information we have provided.” — Pam Hendrickson, Vice Chair at The Riverside Company

Theme 3: Specialized talent offers a competitive advantage

One theme that started to stand out in 2021, and will likely continue to be true for years to come, was top-level executives leaving companies in search of more flexible, specialized projects that put them in the driver’s seat. What does this mean for the PE industry? A shift in focus to interim, specialized talent who can quickly and accurately provide results during the process of due diligence, recruiting, and beyond.

The expert’s take: “The private equity industry used to be about optimizing companies to get attractive returns. Today, it’s very competitive with hundreds of sponsors participating in every auction, often paying perfect prices for imperfect companies. To stand out, PE firms need to see something that’s not in the investment bank’s book. General insights from generalist advisers don’t cut it anymore. We’re equipping our clients with specialized resources that identify unique information that gives them a fundamentally different perspective in a competitive process.” — Sean Mooney, founder/CEO of BluWave

Theme 4: Prioritization of remote work

After years of testing the idea of working from home, the last two years have catapulted the acceptance of remote work—and working from anywhere—to the top of the “normal” list. In fact, companies report that a substantial number of new employees are prioritizing the ability to work remotely even ahead of a robust benefits package.

The expert’s take: “Candidates who were fortunate enough to be employed during the pandemic but unfortunate enough to deal with the constant disruption and stress are now coming up for air and looking around for new adventures. In tandem with this ‘fancy shiny object’ job search, most candidates learned that much of their knowledge and skills could be effectively managed remotely. That’s a game-changer. Once people figured out they could live in Park City, Utah while working for a company based in New York City, many of them made substantial lifestyle changes to strike that elusive work-life balance. It almost gave people permission to shed old norms and start fresh. They went from thinking, ‘I’m going to be stuck in an office for the rest of my life,” to “holy cow, I can work on the ski slopes!’ — William Tincup, President & Editor at Large for Recruiting Daily

Theme 5: Scarcity and its future implications

One thing is certain—from supply chain to the workforce, scarcity seems to be a theme du jour, if not douze mois une année. But how troublesome is it as we move into 2022, and what can we hope for in terms of how the economy will adjust?

The expert’s take: “Usually shortages are a sign of price controls, and usually when people say ‘we don’t have enough workers’ it means that the price they have to pay is too high to get the workers. Historically, there have only been shortages when raising prices is forbidden. This happened with gas controls in the 1950s. The puzzle with today’s shortages is why don’t suppliers just raise prices? My presumption is that they are afraid of being judged as gougers either by their customers or by the government. Eventually, prices will increase, instead of the other option: not having products. It’s already starting to happen. This will help eliminate the pressure on the supply chain.” — Russ Roberts, host of EconTalk and Hoover Institute Research Fellow

Theme 6: The rise of impact investing with a focus on ESG

Almost every investor you talk to these days, whether for a public or private company, has one thing top of mind: how are our portfolio companies performing against ESG standards, including the initiatives around diversity, equity, and inclusion (DE&I). While ESG has been an important reporting tactic for years, only in the last two has it reached the tipping point. Many firms have already seen a positive impact by investing in diverse workforce development, and it seems that it is definitely possible to have success with a triple bottom line investment thesis.

The expert’s take: “We recently made an investment in a waste management company and our investment thesis was to formalize all policies and procedures, then top grade the management team. After implementing our suggested changes, the company attracted a more diverse workforce, which in turn embraced the ‘professionalization’ of the company. This included the way the company related to and communicated with its diverse customer base. As a result, the company improved its margins, increased customer retention, and was better positioned to win larger contracts from commercial customers.” — Colleen Gurda, Founder of Riveter Capital

Theme 7: Family wealth expands into new industries through collaboration

Family wealth, most often managed by family offices with a staff of ten or fewer employees, is reaching beyond the usual suspects of real estate and legacy business toward direct investments in emerging markets. What was once thought to be “old money” is now shapeshifting with younger generations of family members at the helm, many of whom are interested in collaborating with other family offices to expand their reach.

The expert’s take: “Direct investing has been the core strategy for families for decades. What we’ve seen is an increase in collaboration between family offices that happened less regularly before. For the most part, private equity has been taking the lead on lower market buyouts; and families see the upside and potential of that. Pooling resources allows families to reduce risk [in industries they aren’t as familiar with] and take advantage of companies that land between $3M and $20M EBITDA, who are looking to sell. Families are also looking at platform plays such as buying up HVAC companies and other firms within an industry. We are also hearing a lot of talk now about ESG, and also “business drivers” both of which contribute to innovation.” — Glen Johnson, President of Membership at Family Office Exchange

Theme 8: As consolidation continues, culture is a top priority

While company culture is certainly an important part of any organization’s success, during and after an acquisition the focus on maintaining a “healthy culture” is paramount—and is often the difference between a smooth or rocky outcome. Add-ons and consolidations will continue to be at record highs in 2022, and acquirers are best served to create a solid strategy to ensure culture remains at the top of the priority list.

The expert’s take: “Here’s what we’ve learned with nearly 75 acquisitions under our belt, some of which worked and some didn’t. First and foremost, it has to be a business fit. A lot of people will buy companies when there isn’t a reason for the companies to be together. It’s just about size and irrelevant to the core business; you see this a lot with tech companies. But it’s not only about the business fit; there also has to be a cultural fit.” — Troy Templeton, Managing Partner at Trivest Capital