Healthcare is a hot sector for private equity firms looking to acquire new portfolio companies.

Buy-side commercial due diligence on healthcare compliance is table stakes before any deal gets done.

One expert service provider from our network says his firm has seen an influx of diligence requests in this industry since the beginning of 2022, and it hasn’t slowed down since.

“There continues to be a lot of interest in the healthcare sector, whether it’s device manufacturers or contract manufacturers, and even services,” Don Jenkins* of M&A Healthcare Experts says. “Whether it’s tele-health-related services or just other technology platforms that can address healthcare service delivery.”

Here are some of the top trends and must-haves in healthcare due diligence.

Private Equity: Healthcare Sector

With so much money to spend on hand, Jenkins says that middle-market private equity is all over the map.

When he thinks about the last 50 projects they have done for private equity firms, he estimates they would span 20 different markets.

There are a couple, however, that have stood out since as we head deeper into an uncertain, if not turbulent economy. One of those is healthcare.

Firms want to dig deep to learn more about the devices and software systems being used in hospitals. Just as popular, though, are in-home services that allow people to receive diagnosis and treatment from the comfort of their home. This trend has become especially important since the onset of COVID.

Healthcare Due Diligence Process

“Essentially the goal of commercial due diligence is to validate the story that the target’s telling, or to identify the reality of the marketplace out there so that they can make an informed decision on their investment,” Jenkins says.

While the fundamentals of commercial due diligence are the same from one market to another, there are nuances to businesses based in hospitals, pharmacies and other related medical organizations.

Since these companies are creating or using products that affect people’s health, there’s increased risk, which means more scrutiny is needed.

“It can be a very different set of objectives, but if it’s a product, then there definitely will be regulatory issues involved,” Jenkins says.

Top Trends in Healthcare Due Diligence

Service providers in healthcare aren’t just trying to make better products and improve services, they also want to be more affordable.

“It’s still technology, but we’re not trying to design the greatest device, the greatest stent in the world, or the greatest cardiovascular diagnostic product ever made,” Jenkins says. “It’s really what sort of products and services can we develop that are going to not only get the job done, but do it in a more cost-effective manner so that it’s more affordable for the healthcare ecosystem.”

In particular, that ecosystem includes insurance providers and patients. The easier it is for them to engage with a health company’s products or services, the more successful the business will be.

“There are just a lot of moving parts in healthcare that make it an interesting space,” Jenkins adds.

BluWave co-head of research and operations Scott Bellinger most frequently fields calls related to these areas:

- Medical Devices: “Regulatory review on manufacturing processes to make sure they’re FDA compliant.”

- Operational Diligence: “Understand how you can manufacture those devices at a faster more efficient clip.”

- Ancillary Service Buildouts: “For example, if you’re ear, nose and throat, do they have an ambulatory services center?”

Jenkins isn’t the only one seeing an increased demand for commercial due diligence in healthcare. It continues to be one of the most important industries to our clients as well.

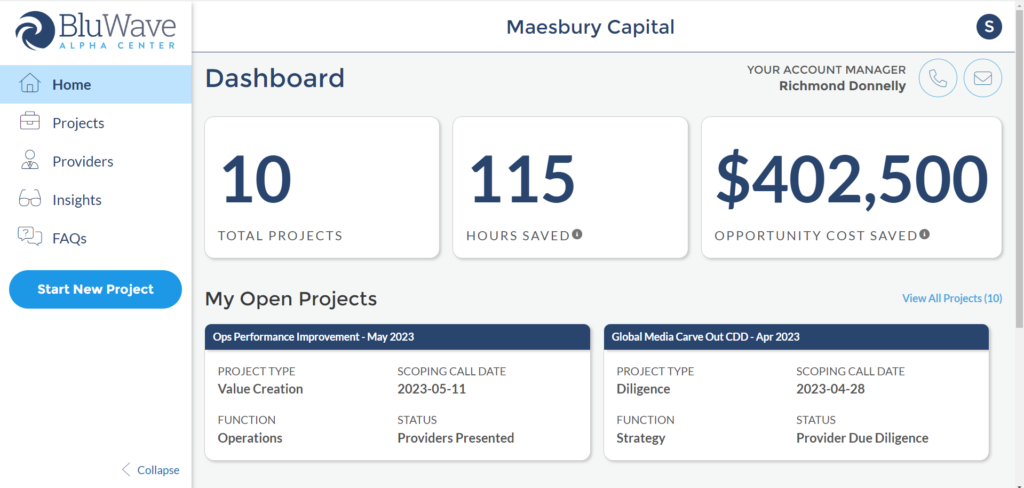

That’s why we spend so much time connecting with and evaluating due diligence service providers who know healthcare – and every other sector that touches private equity – inside-out, backward and forward.

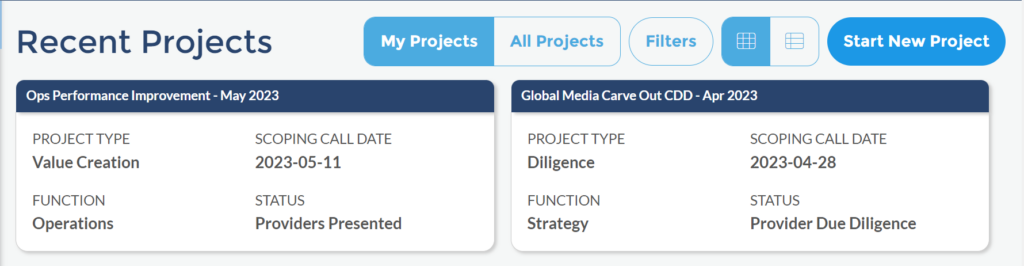

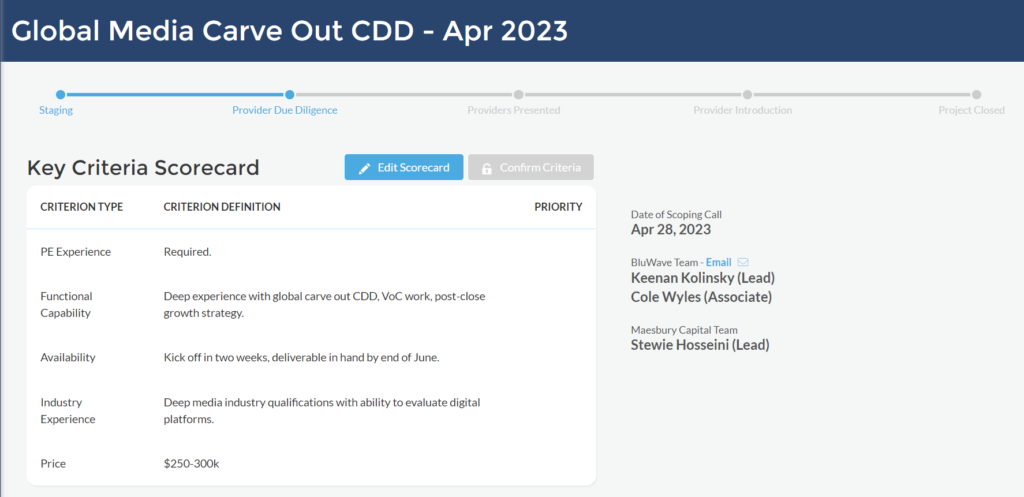

Our research and operations team takes a hands-on, white-glove approach to every project they service, from the first scoping call until after the engagement is complete.

If you’re looking for proven, PE-grade service providers to conduct buy-side diligence on your healthcare acquisition, contact us today. We’ll provide two or three best-fit options for your exact situation and specific needs within a single business day. From there, we’ll hold the third-party resource accountable and make sure they’re meeting all your needs until the ink is dry.

*Privacy is important to us. While the source and company name have been changed, these are real quotations from a real service provider in the BluWave Business Builders’ Network.