Connecting with a service provider you can trust is like looking for a great dentist. Once you find “the one,” you wouldn’t put your teeth in anyone else’s hands.

The same goes for your business. After a successful engagement with a trusted third party, you save a lot of time by contacting them directly the next time you have a need.

There are reasons you have go-to service providers: they’re fast, reliable and they know your business.

But if you love them so much, you’re probably not their only client. Far from it.

So what happens when you reach out and they tell you they simply don’t have the capacity to take on more work on the timeline you need? Or worse yet, they give you their B-team.

We’re glad you asked.

There are a number of reasons service providers could suddenly be in high demand. A bounce-back from a recession. A surge in deal flow. A hot new trend of which everyone’s trying to stay ahead.

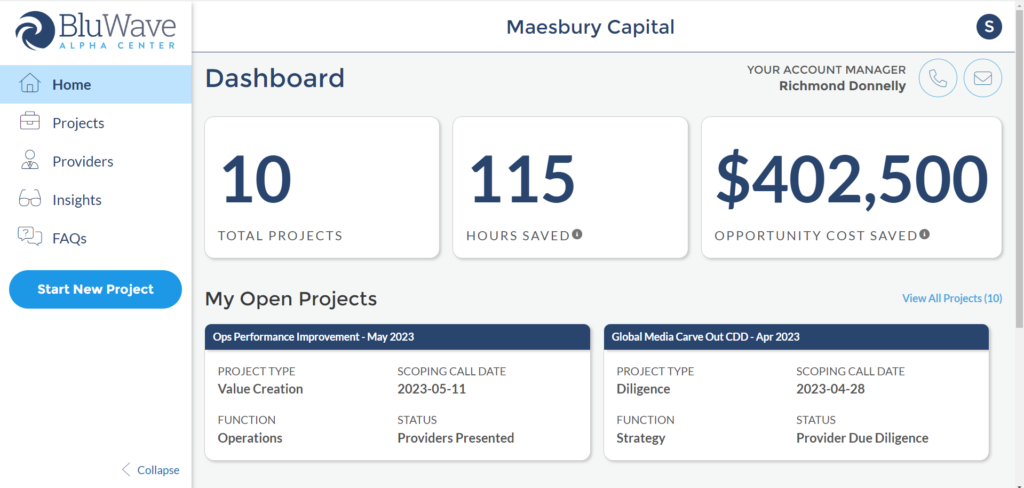

When this happens, BluWave is on standby with a deep bench of trusted, PE-grade third parties who can deliver the exceptional work you expect no matter what your industry.

In fact, we experienced this post-COVID recovery when the whole world got back to business at once and it seemed like there wasn’t enough help to go around. At that time, we heard from dozens of private equity firms that couldn’t book their preferred third-party resource.

We helped those firms by connecting them with industry-specific firms and consultants that understood their business’s most pressing needs.

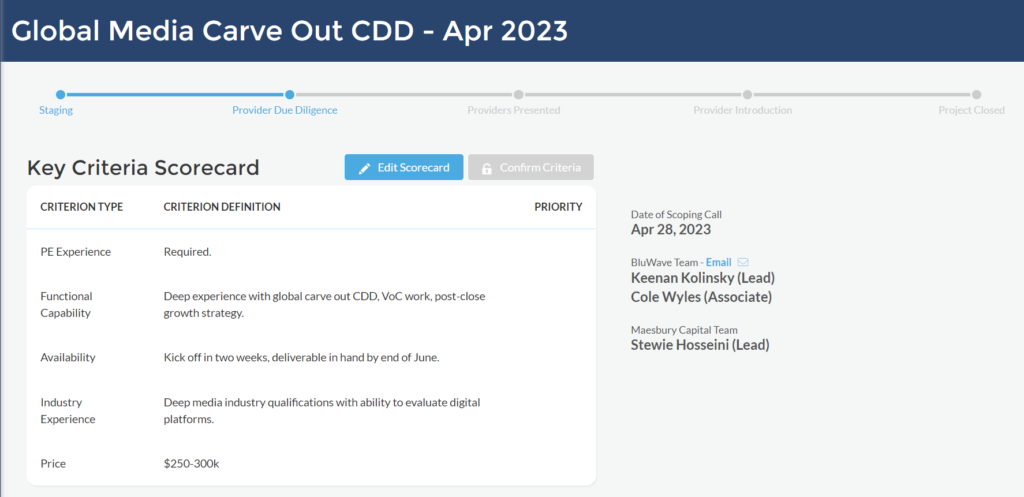

Every service provider in the Business Builders’ Network has gone through a rigorous vetting process, giving us confidence in every match we make whether it’s a first-time engagement or a repeat relationship.

BluWave founder and CEO Sean Mooney has three tips for organizations when their usual service providers are at full capacity.

1) Use Alternatives

“If you’re go-to is sold out, don’t try to force them into giving you capacity. You’ll get the C team,” Mooney says. “There are plenty of other comparable PE-grade specialists that you should use.”

2) Use Substitutes

“There are other diligence and value creation products that go by a different name but still serve your need,” he adds. “For instance, if you can’t get a commercial due diligence group to meet your deadline, use a voice of the customer group to do a deep dive on your target’s customers.”

3) Use Independent Consultants

“There’s a select world of independents who spun out of name-brand shops and can give you the same product at a fraction of the cost,” Mooney says. “This cohort works well not only for commercial diligence, but also for operational and HR diligence as well as value creation.”

Mooney recognizes that trusting your most important work to new partners can be scary. With the right introduction, though, the risk can have a huge payoff.

“Using new groups can be nerve-racking,” he says, “but the BluWave network of PE-grade resources is on standby to meet your specific needs.”

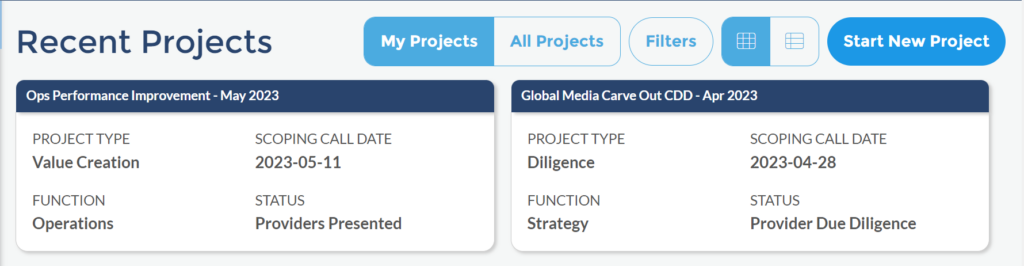

Whether your go-to service providers are at full capacity, or you just don’t know who to turn to, give our research and operations team a call. They’ll connect you with a shortlist of exact-fit third parties within a single business day, and be by your side until the completion of the project.