Need: Value Creation

Making Life Easy for Human Capital Leaders

BluWave understands the urgency and sensitivity around the work human capital executives perform. That’s why we provide a curated suite of resources specifically designed for HR leaders to drive unprecedented value in their organizations.

CASE STUDY: Diversifying Talent in a Digital-First Consumer Products Startup

Our Business Builders’ Network not only understands your unique challenges but also provides tailored, bespoke solutions for talent leadership.

CASE STUDY: Controller with Leadership Skills for Resilient Growth

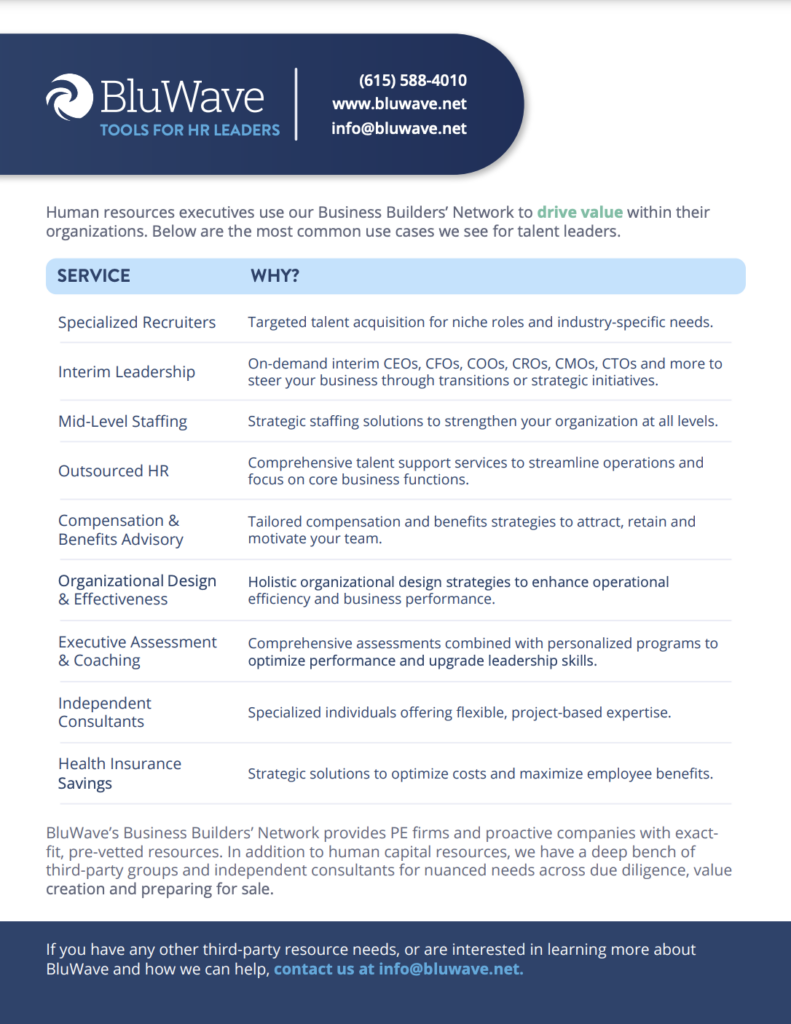

From specialized recruitment that targets niche roles to interim leadership that ensures your business doesn’t miss a beat during transitions; from mid-level staffing strategies that fortify your organizational structure to outsourced HR services that let you focus on core business functions — BluWave already knows the third-party service provider or consultant you need.

You can learn more about these services in this one-pager we prepared for talent leaders.

Set up a scoping call with our resources and operations team, and they’ll connect you with a select list of exact-fit resources within a single business day.

Strategic Executive Search for SaaS Sales Leadership

Service Area: Human Capital – Recruiting

Client Type: Upper-Middle Market PE Firm

Service Provider Type: Executive Search Firm – Sales

Industry: Technology – SaaS

A SaaS company, focused on local and municipal government solutions, needed a chief revenue officer to enhance its sales function and spearhead geographical and product expansion.

The challenge was to find a CRO with proven experience in SaaS sales to local and municipal governments. This person also needed to be capable of transforming a small, technology-centric team into a robust sales force. For this, they would need a specialized recruiting firm.

BluWave utilized its extensive network to connect the client with an executive search firm specializing in sales leadership recruitment within the government sector. This group had a deep understanding of the specific skills and experience required for the role and provided a strong short list of candidates.

The firm worked with the company to hire a chief revenue officer who matched the company’s specific needs. This strategic appointment set the foundation for significant sales growth and expansion in the government sector.

Interim CFO To Revolutionize Financial Forecasting for Construction Portco

Service Area: Human Capital

Client Type: Construction Services Portfolio Company

Service Provider Type: Interim CFO

Industry: Construction and Engineering

A leading construction services portfolio company needed a sophisticated 13-week cash-flow model. This would help them implement an effective borrowing needs forecast, which was especially critical due to their transition to a non-bank lender and the ongoing integration of multiple add-ons.

The challenge lay in integrating diverse business units, each requiring distinct operational and financial strategies. Establishing an efficient system for forecasting collections and payments, integrating add-on companies and maintaining centralized accounting was crucial, given the extensive pipeline of add-ons to be managed promptly.

BluWave identified a short list of industry specific interim finance leaders with specific expertise in the construction industry’s complex financial structures. The candidate the portco selected had experience creating 13-week financial models and was exactly what the client needed. BluWave’s fast connection led to the implementation of bespoke forecasting and budgeting methodologies, essential for the client’s aggressive growth and integration plans.

The interim CFO’s introduction facilitated a smooth transition to an effective 13-week cash flow model, custom-designed for the client’s business framework. This strategic move significantly improved the company’s ability to manage borrowing needs and effectively handle their considerable add-on pipeline, leading to more streamlined financial operations and paving the way for successful growth and integrations.

Revolutionizing Healthcare: Roles of AI, Machine Learning

The integration of artificial intelligence (AI) and machine learning in healthcare is poised to revolutionize the industry by enhancing efficiency, transforming medical education and augmenting the role of healthcare professionals.

The latest Private Equity Insights Report from BluWave shows strong interest in AI data analytics as well as robust activity in the healthcare industry.

LISTEN: The Window of Opportunity: Healthcare and PE Insights

Scott Becker, founder of Becker’s Healthcare and Partner at McGuireWoods, discussed these topics with BluWave CEO and Founder Sean Mooney on the Karma School of Business podcast.

Efficiency in Healthcare Processes

Becker’s insights into the role of AI in healthcare reveal a significant shift toward efficiency, particularly in areas like revenue cycle management.

He spoke to the remarkable reduction in workforce requirements.

“You’ve got places that have 1,500 employees. They can get down to 1,000 employees with using AI,” he said.

READ MORE: Healthcare Compliance: Due Diligence Checklist

This reduction is not about diminishing the human element but rather reallocating it. By automating routine and repetitive tasks, AI allows healthcare professionals to focus their expertise on more complex and nuanced cases.

This shift is not just a matter of numbers; it represents a fundamental change in how healthcare operations are managed. Becker elaborated on the challenges faced in staffing these roles.

“A lot of those jobs are relatively lower-wage jobs where the turnover was tremendous,” he added.

This also speaks to the importance of AI in creating a more stable and focused workforce.

READ MORE: How To Extract Data from ERP Systems

Transformation of Medical Education

Becker also said that the medical education system is in dire need of an update.

“Medical school is still designed pre-internet,” he said. “A specialist isn’t out of school until they’re in their early thirties.”

This not only prolongs the training period but also imposes significant financial and mental burdens on aspiring medical professionals.

READ MORE: Professional Healthcare Recruiters: Specialized Human Capital Resources

“You’ve got this horribly inefficient medical school program and residency training program,” he added.

By leveraging artificial intelligence for educational purposes, the learning process can be significantly streamlined, reducing both time and cost for students.

Augmentation of Medical Professional Roles

There are many use cases for existing medical professionals as well. Mooney offered one example.

“They’re going to have these amazing copilots that will help do all those kind of brain sequences,” he said.

READ MORE: AI Data Analytics: Business Intelligence Tools

Mooney views AI as a tool to assist, rather than replace, human expertise. AI’s ability to process vast amounts of data and identify patterns can significantly enhance the diagnostic process, allowing medical professionals to focus on critical decision-making and patient care.

“I don’t think you could ever turn them over to the robots, at least in our visible future,” Mooney added.

The integration of AI promises to elevate the quality of healthcare, making it more precise, personalized and effective.

While the potential of AI in healthcare is immense, challenges such as resistance to change and vested interests could impede its adoption. Its future prospects, however, are promising.

The integration of AI and machine learning in healthcare represents a significant shift toward more efficient, effective and personalized care.

The invite-only Business Builders’ Network is full of AI experts who work with healthcare businesses on a regular basis.

Connect with our research and operations team, and they’ll provide a short list of tailor-made resources within 24 hours.

Listen to all the episodes from the KSOB podcast.

Interim Ingenuity: Ready-made Executives to Elevate Your Company

Why Private Equity Invests in People for Growth

Human capital is a driving force for growth in private equity. A recent BluWave-hosted webinar delved into three leading trends in this service area:

- The rise in human capital investments

- The importance of specialized recruiters

- The value of interim executives

Here are some insights into these topics from Account Executive Evan Garoutte and Research and Operations Consultant Taylor Lee.

Human Capital Emphasis

The trend of investing in people for growth continues to gain traction.

READ MORE: Why Hire an Interim CFO

“Human capital activity has been steadily growing and reached an all-time high in Q3 of this year, accounting for 49 percent of all activity coming through the BluWave network,” Garoutte said. “It’s the number one trend in the industry.”

This reflects a 20 percent increase year-over-year, underscoring the importance of investing in talent for organizational growth and value creation.

Using Specialized Recruiters

Engaging specialized recruiters is crucial for efficiently filling both executive and non-executive positions, particularly during growth phases.

“They stay up to date on market trends, salary range and emerging skill sets, which is extremely valuable. The knowledge allows them to identify and attract top talent who possess the right qualifications and of course, and most important would be a cultural fit to the organization.”

READ MORE: Why Hire an Interim Chief Executive Officer

Value of Interim Executives

Interim executives, especially in pivotal roles like CFOs, CEOs and CHROs, provide stability and continuity during transition periods, crisis management and special projects.

“PE firms have found value in being able to try before they buy. And we’ve seen interims convert to full-time employees about a third of the time internally,” Lee said. “There’s just value in confirming that this person can positively see our portfolio companies in the right direction as well as confirm that they’re a culture fit.”

READ MORE: Why Hire an Interim CTO

The discussion underscored the critical role of human capital in driving growth, indicating the various strategies that private equity firms and their portfolio companies can employ.

BluWave’s invite-only network of human capital resources works with PE firms daily to fill needs related to human capital, as well as a wide array of other service areas.

Contact our research and operations team for your next project and they’ll provide a short list of exact-fit service providers within 24 hours.

Transformative Leader for Consumer Products Revitalization

Service Area: Human Capital – Executive Recruiting

Client Type: Small-Market PE Fund

Service Provider Type: Interim CEO

Industry: Consumer Products

A West Coast company, specializing in the design, manufacture and distribution of proprietary consumer products, found itself at a crossroads. With a diverse product portfolio distributed across multiple countries, the company sought a transformative leadership change to navigate operational and strategic challenges. The immediate requirement was an Interim CEO capable of steering the company through a phase of revitalization and setting the stage for a permanent CEO.

The company faced a multifaceted challenge: managing a seamless leadership transition while optimizing operational efficiencies and product margins. The need for a leader who could meticulously balance top-line focus with bottom-line pragmatism was evident. The interim CEO would be tasked with orchestrating a turnaround, optimizing expenses and ensuring product margins were robust, setting a trajectory toward achieving a 20 percent EBITDA boost.

BluWave leveraged its extensive network to connect the PE fund with a short list of exact-fit interim CEOs. Each one was aligned with the company’s unique needs and industry nuances. The focus was on identifying a leader with a profound understanding of consumer products, operational optimization and strategic revitalization, coupled with a geographical alignment to the company’s headquarters.

Through BluWave’s precise connection, the company chose a leader who resonated with its transformation objectives. The interim CEO, equipped with the requisite expertise and strategic foresight, was poised to guide the company through a period of transformative change, laying a solid foundation for sustainable growth and operational excellence in the consumer products domain.

Scott Estill of Lancor: Human Capital’s Evolving Role in Private Equity

Scott Estill recently joined the Karma School of Business podcast, sharing his insights into the dynamic world of private equity, with a focus on human capital.

In a captivating discussion with host Sean Mooney, Estill, a seasoned professional with a wealth of experience in executive search and private equity, discussed the transformative trends shaping the landscape of talent acquisition and management.

He emphasized the essence of human relationships, the mutual selection process in recruitment and the necessity of navigating technological changes with agility and adaptability.

Here are some pivotal insights from their conversation.

3 Takeaways from Scott

1. The Importance of Human Capital in Private Equity

Private equity’s approach to human capital has evolved, placing a stronger emphasis on the value of talent and human relationships in driving business success.

READ MORE: Hire an Interim CHRO

Estill articulated this evolution, emphasizing that the real value lies in the talent that propels the business forward.

“What matters more is what’s your right to win. It’s not necessarily about picking the right weighted average cost of capital or whatever it is for the inputs of the model and how much debt to put on a business. It’s the people,” Estill said.

Mooney also highlighted the industry’s shift toward a more human-centric approach.

“This whole idea of this openness to get a candidate to be wanting to be with you and saying, ‘Call anyone you want.’ That’s something that is relatively new in private equity, but incredibly important,” he added.

2. The Shift in Approach: From Assessment to Mutual Selection

The recruitment process in private equity is transforming into a mutual selection process where both parties assess each other.

“You do need to show the human side. That’s sort of why operating partners exist. And we do a ton of operating partner work because you need the EQ-IQ combination,” Estill said. “But I think painting with a wide brush, if PE firms can be more and more human about what it is to work with them and why they value that talent, it makes the talent of course feel good and it differentiates them from the competitors.”

Mooney said private equity has always been, appropriately, private in the way it operates. But that is shifting.

“One of the biggest evolutions that I think private equity is going through right now is the first word in private equity has always been private. It’s all about kind of holding your cards tight and trying to be this kind of vessel and it’ll drive great outcomes,” he said. “Increasingly, there’s things going on like brand formation. … There’s heads of human capital or HR that are not only looking outwardly but inwardly.”

3. Embracing Technological Changes

In an era marked by rapid technological advancements, the ability to adapt and evolve is crucial. Estill underscored the necessity of embracing these changes.

“The only thing that’s consistent is change. So it’s going to happen. And so as much as we think we’re so smart and we’re trying to get ahead of the curve, we’re already dinosaurs,” he said.

Mooney emphasized the transformative potential of technology in reshaping the industry.

“If you lean into it and embrace it, it can be a good thing,” he said. “But it’s scary in the meantime.”

Estill’s insights illuminate the evolving landscape of private equity, underscoring the pivotal role of human capital, the transformative nature of the recruitment process and the imperative of adaptability in the face of technological advancements.

The entire conversation with Mooney offers nuanced perspectives essential for navigating the complexities of private equity in a human-centric manner.

When you’re done listening, head to the main BluWave podcast page for more conversations with business leaders.

Scott Estill, Lancor | Talent Dynamics in Private Equity: How Firms are Refining their Approach

Andrew Greenberg of GVC: Specialization, AI, Adaptability in Investment Banking

Andrew Greenberg recently joined the Karma School of Business podcast, sharing his insights into the ever-evolving world of investment banking.

In a discussion with host Sean Mooney, Greenberg – Chief Executive Officer of Greenberg Variations Capital – delved deep into the transformative trends shaping the landscape of investment banking and capital markets. He articulated the significance of specialization, the revolutionary impact of artificial intelligence (AI) and the timeless essence of adaptability in navigating the industry’s dynamic terrains.

Here are some pivotal insights gleaned from their enriching dialogue.

3 Takeaways from Andrew

1. Specialization and Efficiency in Investment Banking

The investment baking industry has witnessed a paradigm shift, transitioning from a broader approach to a nuanced strategy emphasizing specialization and efficiency.

Greenberg discussed this evolution, highlighting the emergence of a new era where the focus is on being exceptional at fewer things to drive insightful outcomes.

“I think that directionally, the process of selling businesses will continue to evolve in the direction of applying expertise to prospective buyers, the company and the value proposition as opposed to the brute force of the marketing exercise,” Greenberg said.

Mooney agreed with Greenberg’s point on expertise.

“I think what you really appropriately pointed out is we’re in this new era and now it’s about specialization,” he said, “and it’s about being better at fewer things and really driving insights to drive outcomes.”

2. The Impact of Artificial Intelligence (AI)

Artificial intelligence stands at the forefront of this transformation, heralded as a monumental efficiency enhancer. Both Mooney and Greenberg agree on its pivotal role in propelling the market toward unprecedented levels of efficiency, aligning seamlessly with the principles of efficient market theory.

“Artificial intelligence has become a big part of the discussion, and I think you and I agree that there’s both steak and sizzle there,” Greenberg said.

BluWave recently published a white paper discussing the crucial steps businesses must take before implementing new AI tools. Mooney believes it’s primed to be the world’s next revolutionary broad-access tool.

“With the advent of AI, this is going to be the greatest efficiency enhancer in my mind since the advent of the modern internet in 1995 with Netscape,” Mooney said. “I 100 percent agree that the world is going to be playing this game and it’s going to be, like anything else, harder and harder to find alpha. But it’s still going to be really good compared to most other things.”

3. The Importance of Adaptability

Navigating the dynamic realms of investment banking necessitates a spirit of adaptability and openness to diverse opportunities. Greenberg advocated for embracing various experiences and being open to different possibilities.

“As things cross your field of vision, have a disposition to try different things,” Greenberg said. “My advice for younger people would be where possible, try to say yes.

Mooney said he could relate to the power of adaptability.

“You think about the things that we do, they require a lot of time. It’s a lot of effort,” Mooney said. “One of the things that I’m always thinking about as I’ve gained a little bit of perspective is, how do I find little life hacks that are not only even just business, but just things that make my life a little easier?”

Greenberg’s insights underscore the pivotal role of specialization, the transformative potential of artificial intelligence and the enduring value of adaptability in navigating the industry’s multifaceted landscape.

The conversation with Mooney is a trove of wisdom, offering nuanced perspectives that are essential for navigating the complexities of investment banking and capital markets.

When you’re done listening, head to the main BluWave podcast page for more conversations with business leaders.