Understanding your executive team’s dynamics, strengths and areas for development is pivotal to your company’s success. Executive team assessments can play a crucial role in this understanding, aligning the leadership team’s skills, behaviors and performance with the strategic goals.

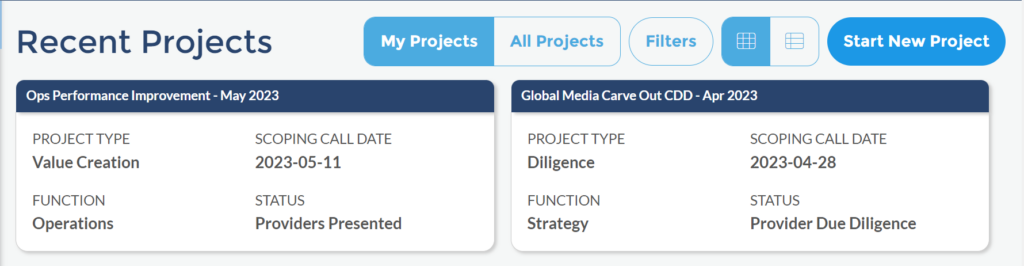

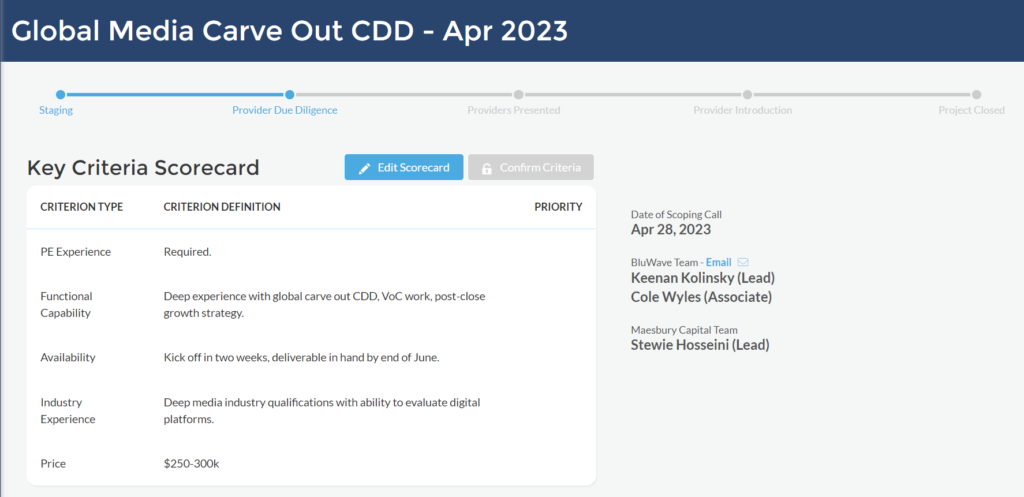

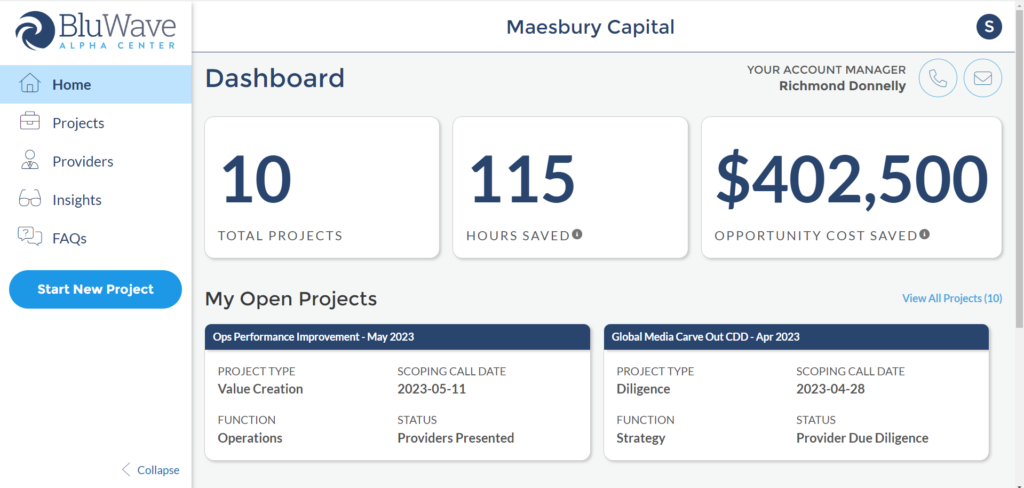

If you’re considering an executive team assessment, BluWave is equipped to connect you with top-tier resources to facilitate the process.

Let’s dive in to better understand what it might look like when you engage a world-class third-party to help.

The Role of Executive Team Assessments

Executive team assessments contribute significantly to crucial business decision-making processes. They help determine hiring decisions, promotions and leadership development strategies. More than that, these assessments shape an organization’s culture, fostering a climate of engagement and transparency.

READ MORE: Unlocking Organizational Success: The Role of Leadership Coaching

Understanding Executive Team Assessments

The primary objectives of executive team assessments are multifaceted. They serve to comprehend team dynamics, assess leadership performance and identify strengths, weaknesses and potential growth areas within the team and individual leaders. The insights gleaned can be instrumental in enhancing team cohesion, clarifying roles and responsibilities, facilitating personal growth, improving leadership capabilities and driving successful succession planning.

Behavioral Analysis

Behavioral analysis provides a method for understanding the behavior, motivations and interaction styles of team members. By scrutinizing these elements, companies can optimize team dynamics, improve communication and facilitate effective decision-making processes.

360-Degree Feedback

The 360-degree feedback process involves gathering performance-related feedback from an employee’s subordinates, peers, superiors and sometimes even external stakeholders. It’s an excellent way to identify blind spots, areas of strength and opportunities for development, contributing to improved performance and higher employee engagement.

Performance Evaluation

Performance evaluations involve reviewing an individual’s job performance and productivity to understand their efficiency. The results of these evaluations can inform promotions, salary increments, layoffs and training needs, offering a robust dataset for assessment.

Personality Tests

Personality tests can help you understand different personality types and how they interact. Moreover, by ensuring that the leadership team adheres to a similar set of values, organizations can maintain consistency in decision-making, operations and company culture.

Alignment with Business Goals

Assessments provide an opportunity for reflection and alignment, ensuring that individual and team efforts contribute to company goals. Through the integration of org chart planning, businesses can gain vital insights into key roles, reporting relationships and team interdependencies.

The Significance of Assessment Results

The results of an executive team assessment can shape professional development plans, improve team dynamics, refine leadership strategies and inform strategic decisions. Incorporating HCM systems software can streamline performance tracking, goal management and feedback collection, further enhancing the assessment process. The role of feedback in the assessment process is instrumental in improving overall organizational performance and fostering a culture of continuous growth and learning.

READ MORE: AI Data Analytics: Business Intelligence Tools

In conclusion, executive team assessments provide invaluable insights into your leadership team’s capabilities and dynamics. They offer a foundation for making informed decisions and fostering a culture of transparency, engagement and continuous growth.

Undertaking an executive team assessment might appear complex, but the rewards of enhanced team performance, strategic alignment and improved decision-making are immeasurable. The BluWave research and operations team is here to connect you with an exact-fit service provider to help you navigate this crucial journey.