Even the most talented athletes never reach their full potential without great coaches. Beyond the ability to see elements of their players’ game that need to be improved or reinforced, effective coaches can motivate players by setting goals, holding them accountable, and providing the right resources for growth and development. While players are responsible for their performance on the court or field, coaches can help them play better than they ever thought possible.

As the CEO of a platform that helps connect private equity (PE) firms with third-party resources, I’ve observed that this isn’t unlike the relationship between these two entities. Just as coaches provide plays, strategies, and training, PE firms give companies the tools they need to improve their products and services, ensure their operations are as efficient as possible, and increase their productivity. To take full advantage of the coaching PE firms can provide, companies have to know who they are and where to find them as well as how to build healthy relationships with them.

What PE Firms Can Bring To The Table

Companies often misconstrue the role of private equity firms. Instead of viewing them as partners, they often regard them more narrowly as sources of capital. It’s long past time to abandon the reductionistic perception of relationships between PE firms and their portfolio companies as strictly transactional. This view maintains that PE firms pump cash into companies, cut costs wherever they can and sell those companies as quickly as possible. Beyond the fact that the median holding period in 2019 for PE firms was 4.5 years, PE firms report that they’re more interested in building strong companies than trying to make overnight profits.

Most PE professionals have worked with hundreds, if not thousands, of companies and have previously been through many of the trials that companies are otherwise experiencing for the first time. Their experiences help them advise which strategies are most likely to be successful and which resources can be used to execute plans most effectively.

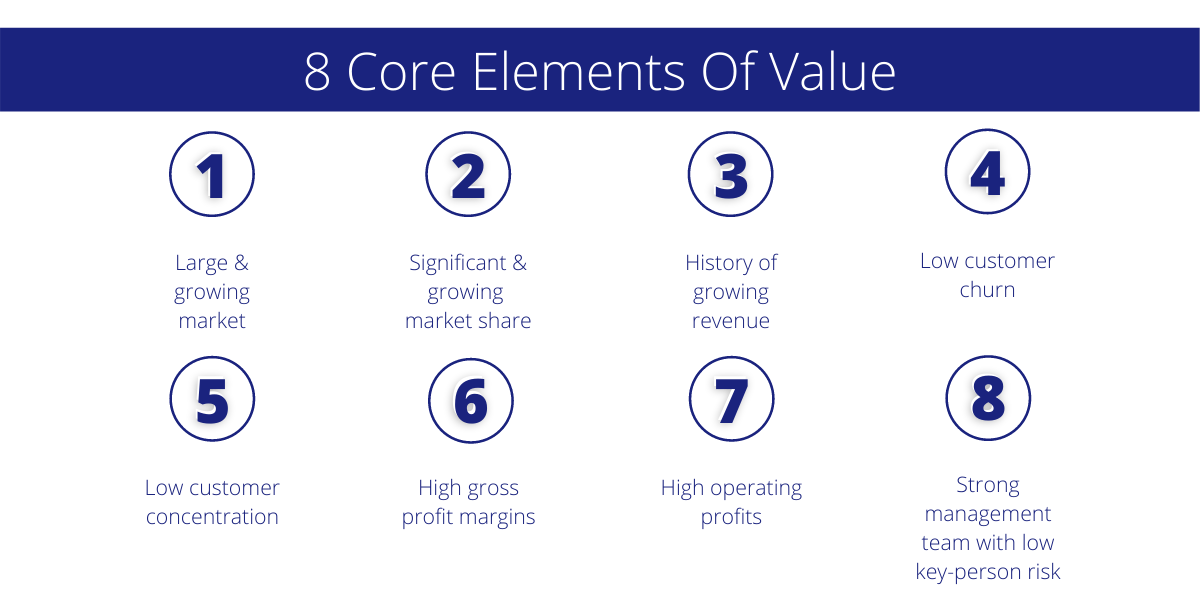

Like coaches, PE funds conduct rigorous assessments of companies’ performance on fundamental metrics (such as market share, customer churn, top-line growth, customer concentration, and profit margins), provide objective appraisals of what’s working and what isn’t, and allow access to the right resources necessary to drive accelerated improvements.

The Process Of Choosing Your Private Equity Coach

The global economy is becoming more dynamic, skills-based, and competitive every day. A recent World Economic Forum report explains that the rapid pace of technological change is leading to major shifts in the types of workers companies employ, while a significant majority of the companies say they’re needing and investing in specialized expertise.

PE firms aren’t just a source of financial support; they also offer just-in-time access to the specialized expertise that companies need to navigate the evolving global economy, especially at a time when we’re recovering from the most significant downturn in years.

In order to get the right fit when it comes to choosing a PE fund partner, you need to do some work. Look for one that is aligned with your industry, the size of your company, and your culture. You should probe the firm on its ability to add value beyond just cutting the check. The best PE funds will have countless examples of how they helped others in similar situations.

If you’d like to take the traditional route to find the right firm, start with your own network. Talk to your acquaintances who have experience working with PE funds and ask for referrals. Next, you could seek out trusted investment bankers who regularly connect business owners with best-in-class PE fund investors in your end market. Lastly, keep in mind that there are networking tools like Axial that can make the process of connecting with PE investors easier. (Full disclosure: My company offers networking solutions for different applications in due diligence and value creation.) Deloitte reports that talent networks now account for billions of dollars in economic activity and hundreds of millions of hires around the world.

Making The Most Of The Relationship

While a private equity coach can have a huge impact, players ultimately have to take full responsibility. The same applies to companies that work with PE funds or advisors of any kind. They should be willing to confront problems honestly, put their coaches’ advice into practice, address failures and celebrate successes. It’s essential to establish norms of transparency and accountability early on in these relationships, and this begins with the alignment of goals and how to achieve them.

For example, what are your definitions of success? Companies and their PE coaches should ask this question right at the outset and arrive at an answer that makes sense to everyone. After deciding what success looks like, it’s crucial to determine which metrics will measure performance. With the scorecard in place, the next step is identifying the resources and capabilities companies need to achieve their goals.

At every stage of this process, open communication and collaboration are key. Both coaches and players need to feel comfortable asking tough questions and openly sharing their thoughts. When a company and its Private Equity coach listens, holds each other accountable and moves forward with a foundation of trust, shared goals, and collaboration, only then can they discover that they’re capable of far more than they imagined.

This article originally appeared on Forbes.com.